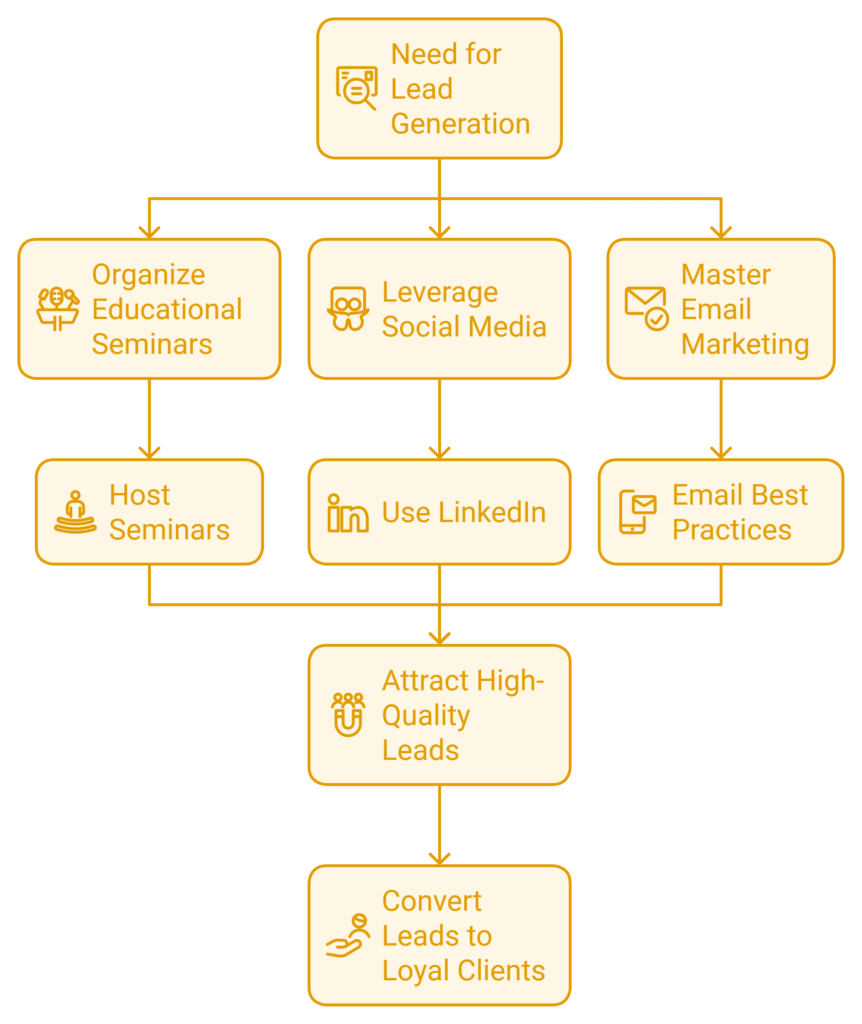

Lead generation is undoubtedly an integral part of growing any financial advisory business. Whether you are an old hat at being a financial planner or an upstart, the right lead generation has the difference between sustainable growth and sinking ships. This blog post will look at how to lead generation for financial advisors, focusing on the ways to attract high-quality leads and subsequently turn them into loyal clients. From hosting educational seminars to leveraging social media platforms like LinkedIn to mastering email marketing, they all can elevate your business.

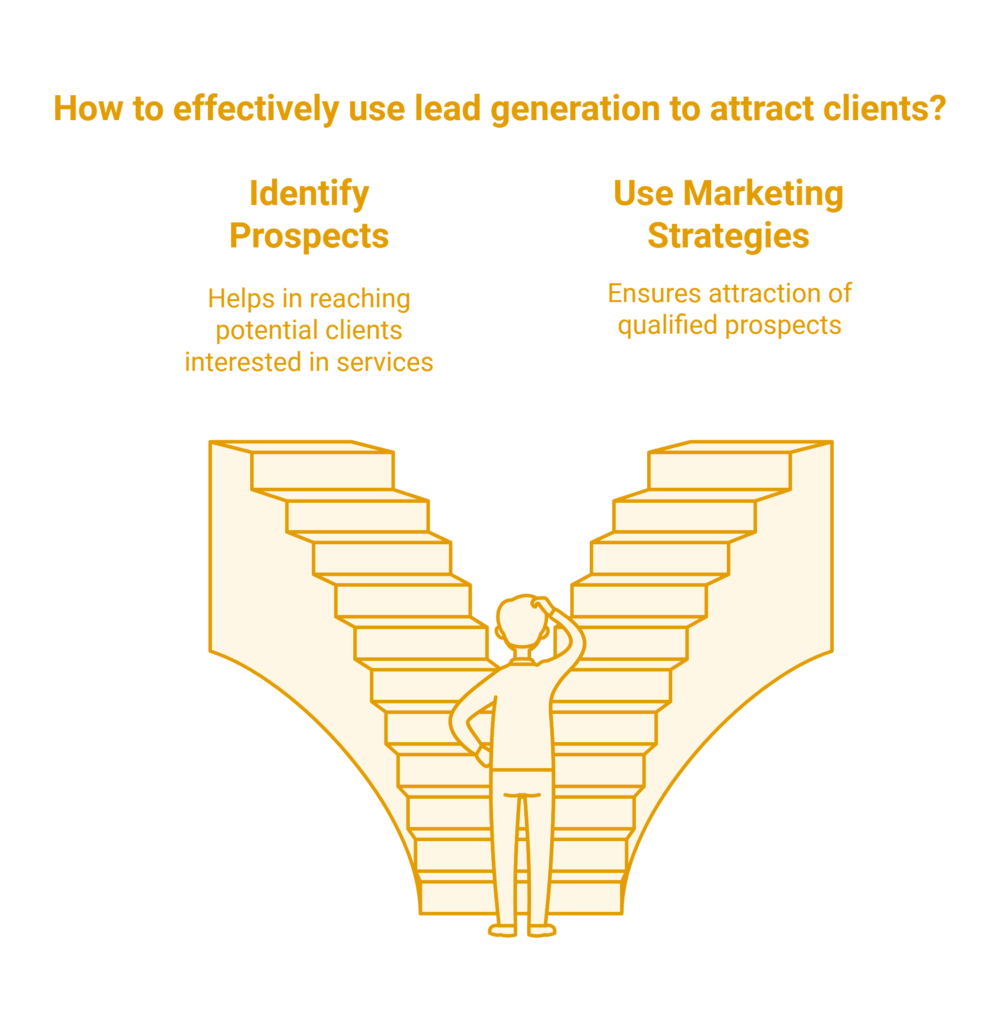

Why Lead Generation is Important for Financial Advisors

It largely depends on the continuous inflow of clients who respect and hold above their heads the reputation or the expertise of that particular financial advisor. That’s, however pretty tricky in today’s market. In the lead generation for a financial advisor, that kind of gap will be addressed. Lead generation serves to help the financial advisor identify and reach prospects who are interested in his financial services. Right marketing strategies are important because they provide you with the surety of attracting qualified prospects and, hence, earning you long-term clients.

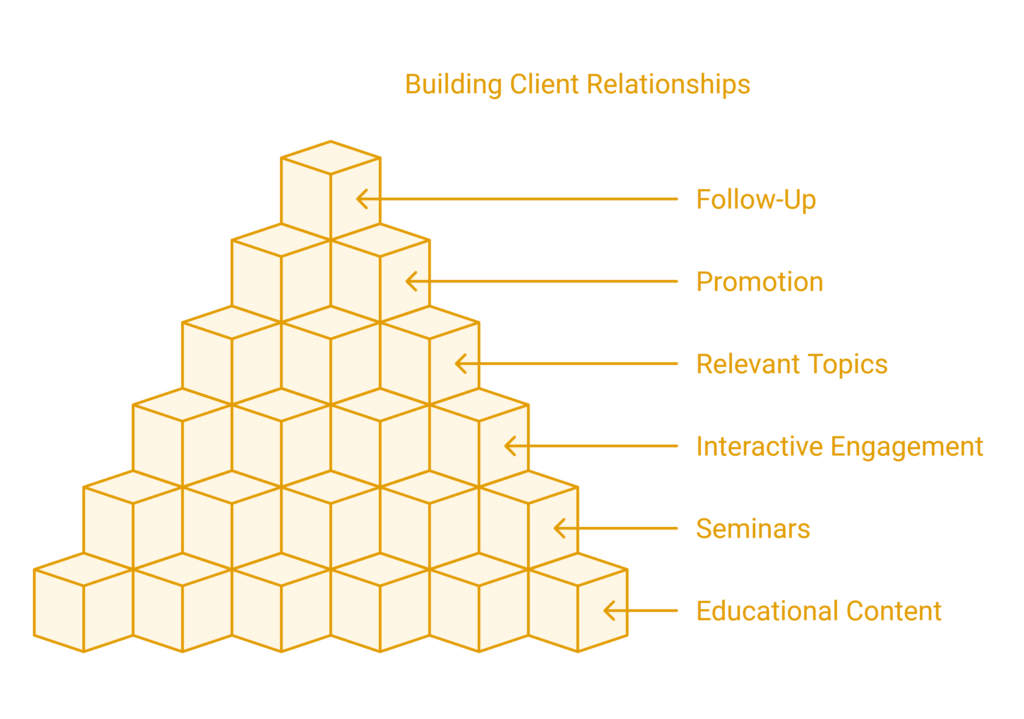

1. Organizing Education Seminars and Webinars

This is one of the most effective ways to obtain leads when you’re a financial advisor. Presenting such useful information on retirement planning, tax strategy, investing opportunities, or personal finance at a seminar or webinar positions you as the expert and draws the right type of individual: those looking to get their finances right.

Why Seminars and Webinars Work

- Educational content is the best method of building trust and authority. The more prospects see you as a resource that knows your stuff, the more likely they are to want your service.

- Seminars attract qualified leads. People coming to a seminar already want financial advice. And therefore, they are likely to be qualified leads compared to a cold call or generic marketing technique.

- Interactive Engagement: You would engage face-to-face or virtually with your potential clients, answer all of their questions, and even become friendly.

How to Make Your Seminars Effective

- Select Relevant Topics: Select topics that are of utmost relevance to your target audience. For instance, if you target retirees, then you may want to focus on retirement planning strategies. If you are working with young professionals, then you may want to focus on saving for a home or managing student loan debt.

- Promote Your Event: Use social media, email marketing, paid ads as well as partner with organizations in your local area.

- Follow Up: Send out follow-up messages to thank them for attending and make available any other resources that may be of great help. This is a chance to schedule one-on-one consultation.

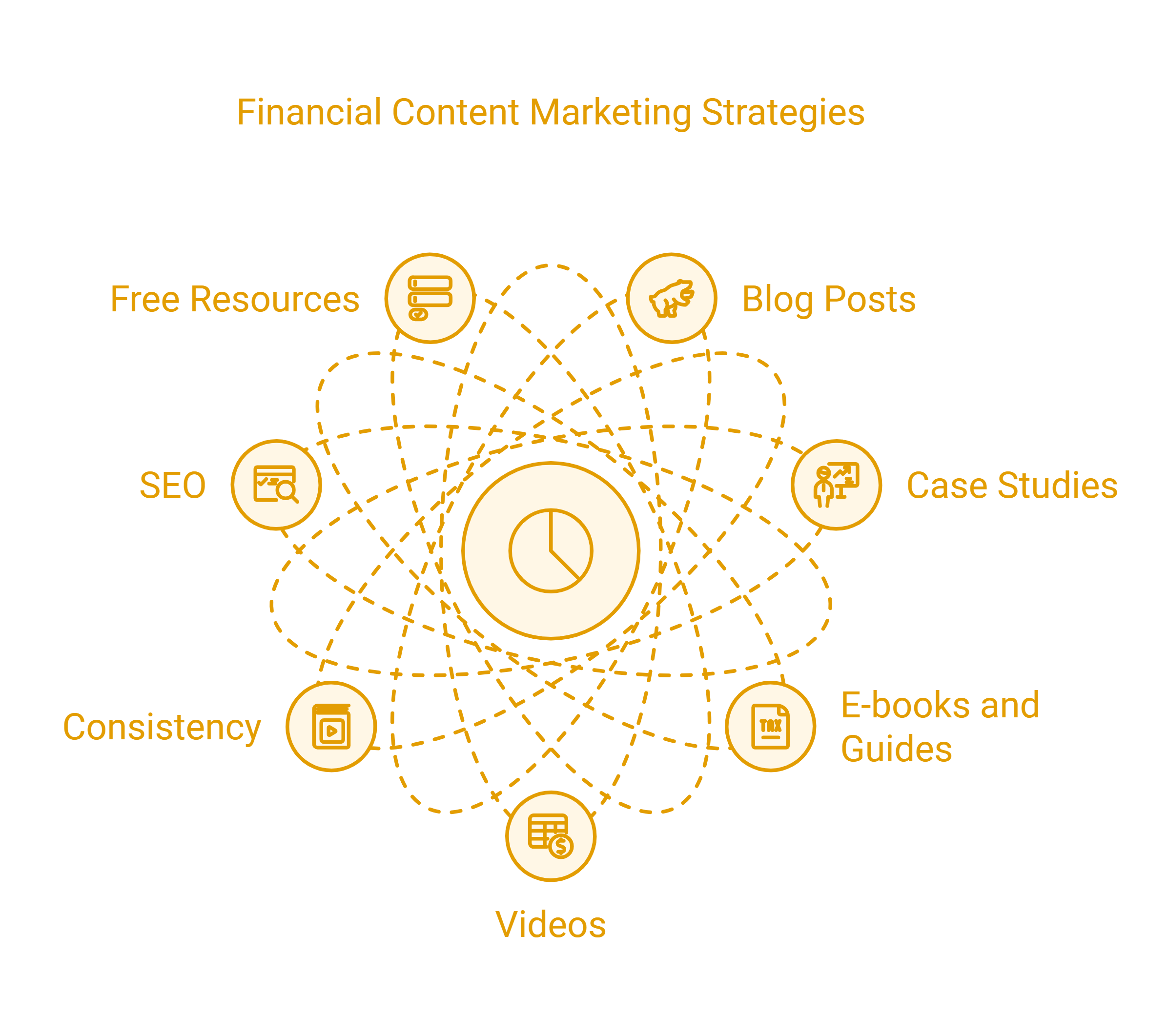

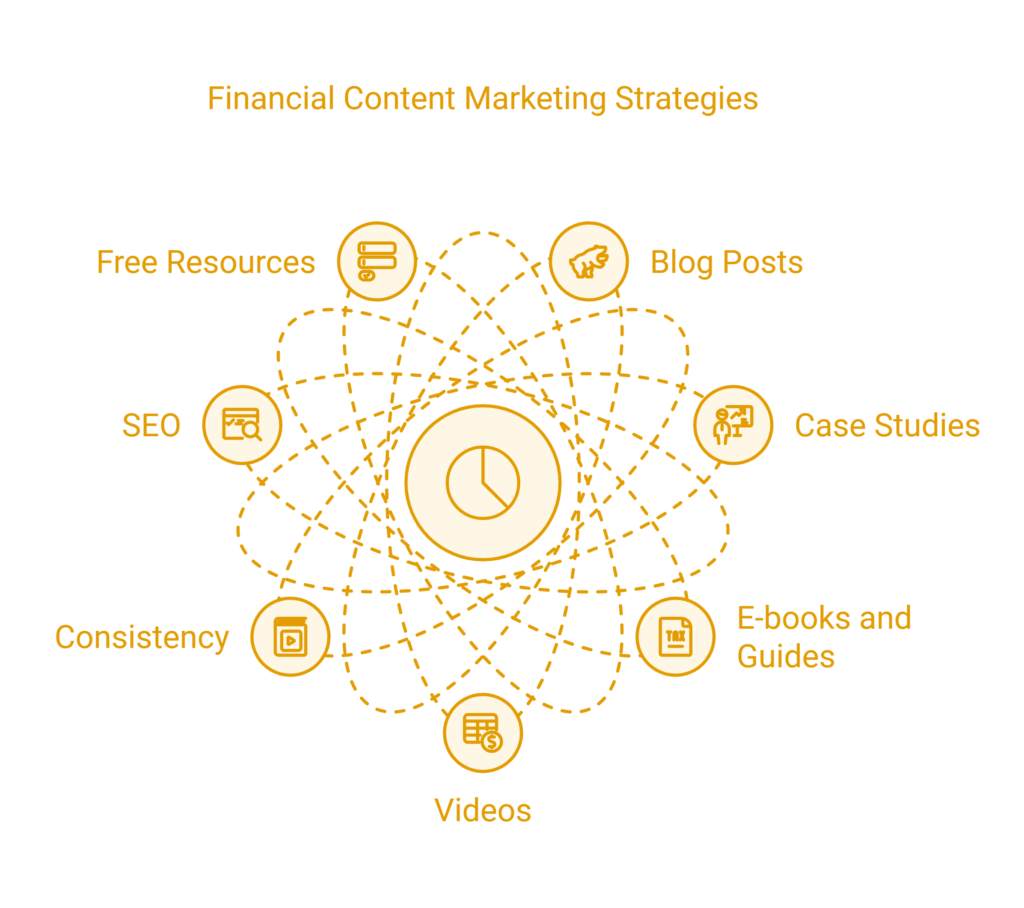

2. Content Marketing: Creating Informative and Engaging Content

One of the best ways to generate leads over time is by creating valuable content. A financial advisor who publishes good articles, blog posts, videos, and infographics on a regular basis attracts prospects searching for answers to their financial questions. This does not only improve your online presence but also positions you as an authority in the finance field.

Types of Lead-Generating Content

Blog posts will have a list of frequently asked questions, which are usually focused on frequent problems with finances: for example, “How to Create a Retirement Savings Plan” or “Best Investment Tactics for Novice Investors.”

- Case studies are extremely helpful for real-life stories where financial advice allowed a client’s dreams to come true.

- E-books and guides can be a comprehensive resource, such as “The Complete Guide to Millennial Financial Planning.”

- Videos: A short video explainer or some testimonies by your clients would engage your visitors and bring in the personal touch of your online presence.

Benchmarks of Content Marketing

- Consistency is the King: The more you release content consistently, the more you remain in the prospect’s thoughts. Consistency also does favors for improving your SEO rankings and hence makes it easier to get found online.

- Use SEO to your advantage by optimizing the content with relevant keywords. If it’s the focus keyword, that should be lead generation for financial advisors. This way, more organic traffic would hit their page.

- Free Resources: Give away free content to collect an email address or other contact information. The free resource could be an e-book, financial calculator, or exclusive access to a specific webinar. Free resources can help capture leads and further relationship development.

3. Referral Programs: Tap Your Current Clients

Word-of-mouth referrals are among the most powerful lead generation tools any financial advisor can have. Happy clients who feel confident in your knowledge and judgment are more likely to send friends, family, or colleagues to you. As such, consider implementing a referral program to incentivize current clients to refer new leads to you.

How Referral Programs Work

One example of a referral program that can be very simple is offering existing clients a discount or bonus for every successful referral that converts into a client. For example, you could offer to give a free financial consultation or a gift card for every successful referral. Financial incentives can sometimes work, but sometimes offering a personalized thank-you note or hosting a client appreciation event is just as effective.

Tips for Running a Successful Referral Program

- Ask for Referrals: Now, it is perfectly fine to ask happy clients straight out for referrals. Be sure to explain how it will be beneficial to them to work with you, and how you can help.

- Make It Easy: Give your client all tools and information needed to refer someone, be it referral form or just a link.

- Incentivize Referrals: Offer concrete rewards for successful referrals, but ensure the incentives are appealing to your clients. A personalized approach may work better than generic rewards.

- Follow Up: After a referral is made, always follow up promptly and show appreciation to both the referring client and the new lead.

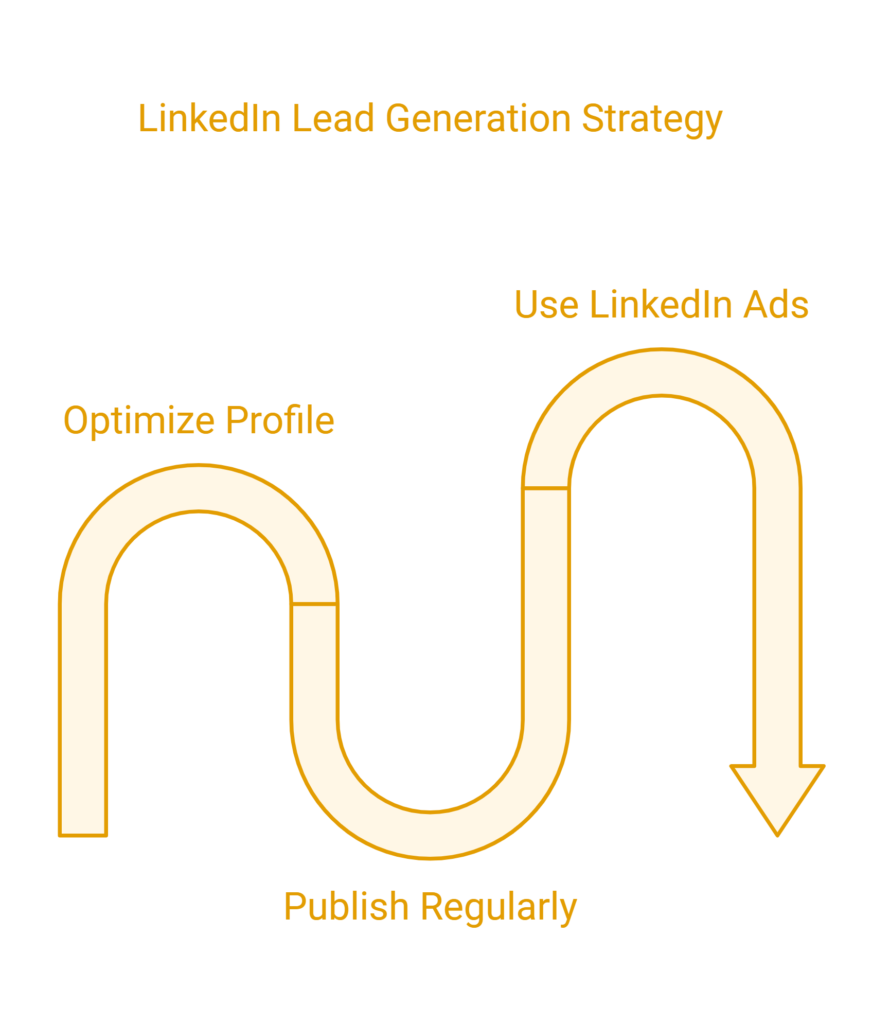

4. Using LinkedIn for Lead Generation

One of the most effective ways to connect financial advisors with prospects and generate leads lies in LinkedIn. LinkedIn is a professional networking site that allows you to reach people and businesses based on profession, industry, and interests.

Why LinkedIn is Critical for Financial Advisors

- Target Audience: On LinkedIn, you can use the search function to focus on profession, job title, and location. That helps you filter down to a profile of the type of individual who would use your financial services.

- Create Trust/ Personal Credibility: The second way to build personal credibility/trust is through sharing articles, testimonials, and stories about a client’s success.

- Prospecting Engagement: LinkedIn is a fantastic channel to engage with your potential client via comments, private messages, or even a group discussion.

How to Use LinkedIn for Lead Generation in Financial Advisor

- Optimize Your Profile: Ensure your LinkedIn profile is complete and optimized with a professional photo, compelling headline, and a detailed summary of services and experience.

- Publish regularly: You can share posts on blogs, articles, and financial advice that would establish your competency. Engage with other posts, join appropriate groups and increase your visibility.

- You can use LinkedIn Ads: They have a great ad platform from which you can target an industry or even a job title. Sponsored content and Direct InMail may be the ideal way to reach your perfect prospect.

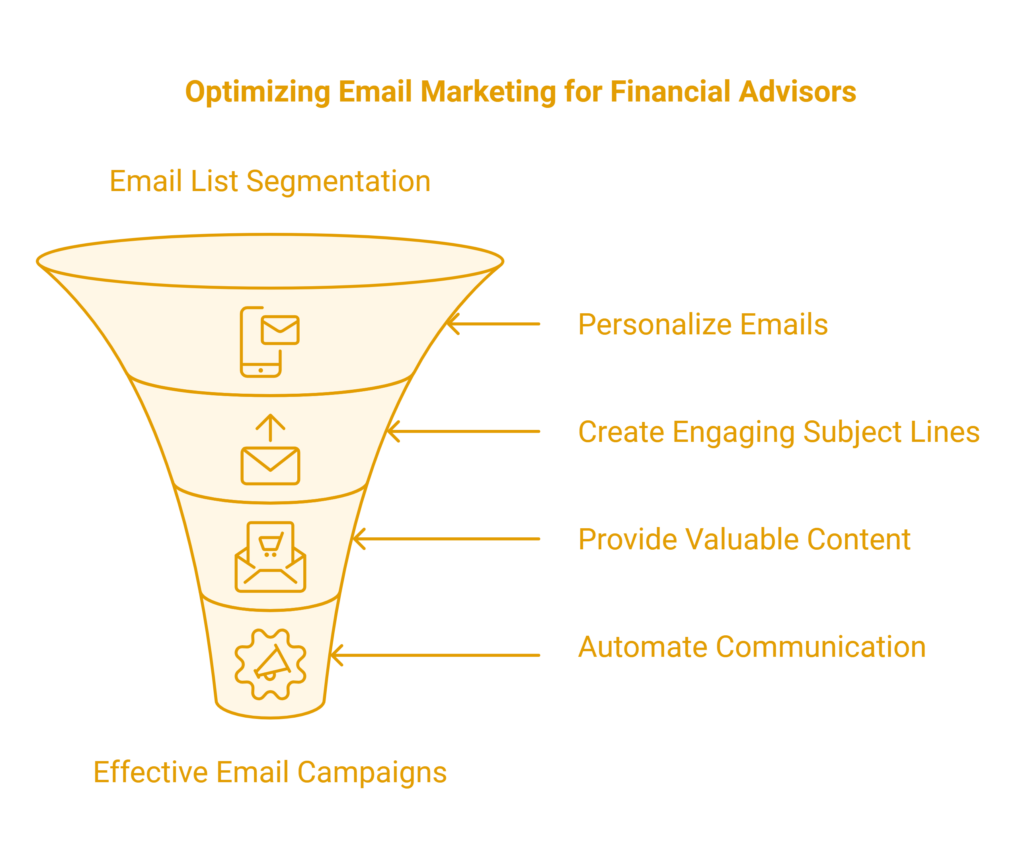

5. Email Marketing for Financial Advisors

Email marketing will be one of the most powerful lead generation tools for a financial advisor. An email can nurture your existing clients or prospects over time. This is how you follow up on your consultation and keep your audience in the picture with regard to new offerings or updates.

Best Practices for Email Marketing

- Categorize Your List: All leads are not the same. You should break down your email list by customer type, stage in the buyer’s journey, or specific needs. That allows you to send the message that resonates best for each group.

- Personalize Your Emails: Use the name of the recipient and also tailor the content to his particular financial needs. Personalized emails have higher open rates as well as conversion rates.

- Make It Engaging: The first thing the recipient will read is your subject line, so use something to draw them in. Use urgency or even curiosity to open your emails.

- Provide Value: Make your emails valuable to the recipient. They could be some tips on money, or maybe updates about the markets, or perhaps exclusive content. Make sure that your email is informative and relevant to your reader.

- Automate: “New lead automated email sequence to welcome messages, and follow-ups. This will provide uniform communication without requiring any effort.”

Conclusion

Trust and value is the door opener for financial advisors in lead generation. By using various methods, including educational events, quality content, LinkedIn usage, and even referrals, you can bring qualified leads regularly. You may also use email marketing to nurture relationships with your current and potential clients.

While each lead generation strategy has its merits, the most effective financial advisors combine some of these techniques to create a holistic marketing plan. What makes it successful is consistency and offering value to your audience. Focus on building genuine relationships and showing your expertise to create a pipeline of leads that will convert into long-term clients and ensure growth in your business. Check out How to Use Geotargeting in Lead Generation Campaigns